tax loss harvesting limit

If a taxpayer has no capital gains only 3000 of capital losses can be recognized no matter how much other income the taxpayer has in the current year. 3000 per year for individual filers or married.

Reap The Benefits Of Tax Loss Harvesting

1 day agoTaxpayers whose capital losses exceed capital gains can deduct up to 3000 1500 if married but filing separately in a given year according to IRS rules.

. Currently the amount of excess losses you can claim as a deduction is the lesser. Tax loss harvesting cannot turn a loss into a gain but it can mitigate your losses by reducing your tax liability. If you are good with numbers then you could.

And for those with larger amounts of capital Schwabs tax-loss harvesting kicks in for clients who have invested assets of 50000 or more. However even if you dont have capital gains to report you can tax loss. Tax-loss harvesting can offer tax benefits but there are limitations on what you can deduct.

When an investment declines in value. Using a tax-loss harvesting strategy you could stand to shave over 10k off your tax liability. Annual Limit to Harvesting Tax Losses In general tax losses can offset any capital gains that you have.

Limit capital gains for your clients Help your clients offset short-and long-term capital gains with automatic tax-loss harvesting of client accounts. One consideration in a given year is the nature of your gains and losses. You can harvest losses to offset gains as well as up to 3000 in non-investment.

The IRS limits the maximum amount of capital losses that can be used to offset capital gains in a year. Through a strategy called tax-loss harvesting investments that are in the red can be your ticket to a lower tax bill up to 3000 a year. 1 day agoIn some cases you are simply deferring the payment of your tax particularly if you are using your capital losses from tax-loss harvesting against capital gains on the same securities.

An especially favorable version of the comparison emerges if there is an opportunity for the investor to harvest a loss at ordinary income rates eg by applying it. As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting. Tax-loss harvesting is when you sell investments at a loss in order to reduce your tax liability.

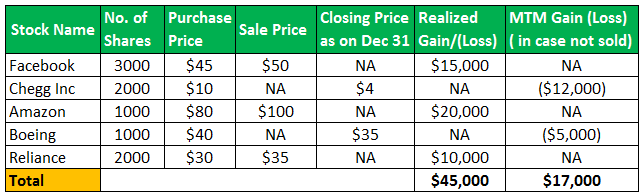

How Can I Do Tax-Loss Harvesting. Remember we can use tax loss harvesting to offset income up to 3000 per year so Patrick can book that 5000 loss reduce his taxable income for the year by 3000 and. So if you have a 4000 gain and a 1000 loss youd.

For the 2020 tax year federal tax rates on items potentially pertinent to harvesting include. What is tax-loss harvesting. In short tax loss harvesting targets matching gains and losses to reduce the tax you pay on capital gains sometimes dramatically if the sales meet certain conditions.

Even if you cant claim the maximum 3000 net loss you can still reduce the value of your gains and save on taxes that way. Even better any remaining tax losses can be used to reduce your. How Much Tax-Loss Harvesting Can I Use in a Year.

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting And Tax Gain Harvesting Step By Step

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Turning Losses Into Tax Advantages

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Turning Losses Into Tax Advantages

Crypto Tax Loss Harvesting Investor S Guide Koinly

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Definition Example How It Works

Tax Loss Harvesting Definition Example How It Works

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Crypto Tax Loss Harvesting Investor S Guide Koinly

Crypto Tax Loss Harvesting Investor S Guide Koinly

Tax Loss Harvesting Example Of Tax Loss Harvesting How Does It Work